Corporate governance

Corporate governance structure

Basic policy

The JT Group believes that corporate governance is a framework for transparent, fair, timely and decisive decision-making in pursuit of the 4S model, our management principle. Pursuing the 4S model means striving to fulfill our responsibilities to our valued consumers, shareholders, employees and wider society, carefully considering the respective interests of these key stakeholder groups, and exceeding their expectations wherever we can.

We have established the JT Corporate Governance Policy in recognition that improvement in corporate governance is conducive to sustainable profit growth and corporate value over the medium and long term, benefits our stakeholders and, in turn, helps to move the economy and society forward. We believe that the Corporate Governance Code has high affinity with the 4S model, and we fully comply with the principles of the Corporate Governance Code, which includes the principles of the Prime Market in Tokyo Stock Exchange.

We will endeavor to continuously enhance our corporate governance as a key management priority.

Rationale behind the current governance regime

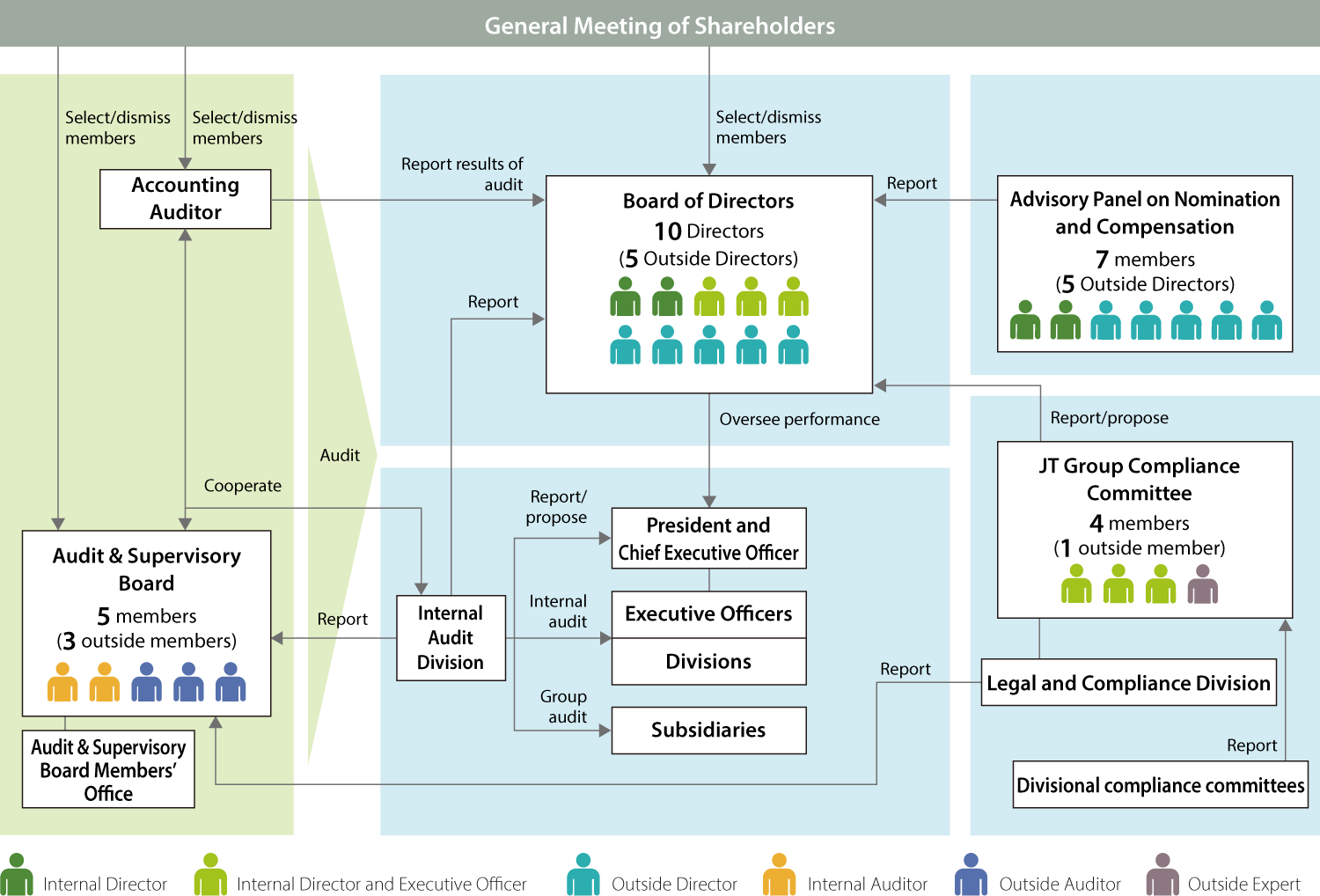

We are strengthening objective and impartial management oversight functions by positioning an independent and fair Audit & Supervisory Board that appropriately oversees the job performance of Executive Officers and Members of the Board (hereinafter Directors). We have built an effective corporate governance regime under the Audit & Supervisory Board’s oversight. It includes the JT Group Compliance Committee and the Advisory Panel on Nomination and Compensation, both established voluntarily. The former is comprised of the President and Chief Executive Officer (hereinafter CEO), Executive Vice Presidents and an outside expert; the latter is comprised entirely of Directors who do not serve as Executive Officers, and more than half of whose members are Independent Outside Directors. We have also streamlined our Board of Directors and expedited operational execution by delegating authority to Executive Officers. We continuously seek to improve corporate governance and increase management transparency and objectivity through, for instance, the appointments of an additional Outside Director and Outside Audit & Supervisory Board Member in March 2019, an additional Outside Director in March 2022, and an additional Outside Director in March 2024. Through such measures, we settled upon our current corporate governance regime as we believe it functions effectively with respect to operational execution and oversight.

Evolution of the governance structure

*1

The committee was abolished at the end of June 2014 following the introduction of the outside director system in June 2012

*2

In conjunction with the restructuring of the Group compliance system, the Group’s Code of Conduct was reorganized, and a policy summarizing the values and ethics of the JT Group, which are common globally, was formulated.

Corporate governance structure (As of March 26, 2025)

Board of Directors

The Board of Directors is the body responsible for determining JT Group management strategies and key issues, and for overseeing all business activities. Board of Directors meetings take place once a month in principle and on more occasions as necessary and promptly, in order to make decisions with regard to important matters, including those specified by laws and regulations, to supervise business execution, and to receive reports from Directors on the status of business execution.

Chairperson: Mutsuo Iwai (Chairperson of the Board)

Number of meetings: 13 in FY2024

Structure

Main deliberation and discussion items:

- Important matters such as formulation of management plans, investment projects (such as acquisition of shares in Vector Group Ltd.), and appointment of Executive Officers

- Progress on financial results, financial matters, and sustainability strategies

- Matters related to Group compliance, risk management, and internal control

- Matters related to the evaluation of the effectiveness of the Board of Directors and the Advisory Panel on Nomination and Compensation

Advisory Panel on Nomination and Compensation

The Advisory Panel on Nomination and Compensation supports the growth of executive candidates, including succession plans; deliberating on the selection of nominees for seats on the Board of Directors and Audit & Supervisory Board and dismissal of designated Directors and Directors also serving as Executive Officers; and reporting the results of the deliberation on remuneration of Directors and Executive Officers to the Board. The Panel’s purpose is to render the Board’s decision-making more objective and transparent and upgrade its oversight functions through deliberation regarding executive appointment and remuneration in accordance with the results of the deliberation among the Panel.

Chairperson: Tetsuya Shoji (Independent Outside Director)

*

Chairperson of the Panel is elected from among Independent Outside Directors by themselves, effective March 2022

*

Chairperson for FY2025 is Tetsuya Shoji

Number of meetings: 6 in FY2024

Structure

Main discussion items:

- Selection of candidates for the Board of Directors and discussions on the skills matrix

- Discussions regarding the selection of a group of companies to benchmark remuneration levels, etc.

- Confirmation of remuneration levels

- Confirmation of executive candidates

- Discussions regarding key performance indicators for executive bonuses and performance share units

Audit & Supervisory Board

The Audit & Supervisory Board consists of five Audit & Supervisory Board Members with abundant experience in the fields of management, law, finance, accounting and others. The Audit & Supervisory Board conducts operational and accounting audits and assertively exercises its authority as an independent body entrusted by shareholders, including attending and speaking at Board of Directors and other important meetings as well as actively inspecting business sites. In addition, it also conducts audits appropriately from an objective viewpoint in accordance with the characteristics of the duties of the Outside/Standing Audit & Supervisory Board Members.

Chairperson: Hideaki Kashiwakura

(Standing Audit & Supervisory Board Members)

Number of meetings: 17 in FY2024

Structure

Main discussion items:

- Discussion and preparation of audit policy

- Discussion and preparation of audit reports by the Audit & Supervisory Board

Evaluation of the effectiveness of the Board of Directors

We evaluate annually the effectiveness of our Board of Directors through a multi-step process. First, all Directors and Audit & Supervisory Board Members complete a self-assessment questionnaire with regards to factors including the Board’s operations, oversight function and dialogue with shareholders and investors. Second, the Board’s administrative staff interview the Directors and Audit & Supervisory Board Members individually as necessary to delve deeper into their questionnaire responses and compile the evaluation results. Lastly, the Board reviews and analyzes the self-assessment results with the aim of further improving its effectiveness.

For FY2024, the questionnaire was administered as outlined below. In addition, external consultants conducted interviews with all Directors and Audit & Supervisory Board Members to explore issues in order to further improve the effectiveness of the Board of Directors.

Evaluation method

-

- Participants: Total of 15 Directors and Audit & Supervisory Board Members

- Evaluation period: 2024 (Jan. 2024 – Dec. 2024)

- Questionnaire drafting period: Jun. 2024 – Sept. 2024

- Questionnaire response period: Sept. 18, 2024 – Oct. 1, 2024

- Questionnaire summary: Evaluation of questions (5 grades) and open-ended responses

- Interview period: Oct. 31, 2024 – Nov. 21, 2024

- Interview summary: Interviews conducted by external consultants based on the questionnaire results

- Discussion by the Board of Directors: Feb. 18, 2025

*

We receive advice from external consultants in drafting and analyzing the results of the questionnaire and interview with the aim of ensuring objectivity and further improving the evaluation process.

Questionnaire evaluation items

-

Main evaluation items are as follows. In addition to items for ongoing confirmation, questions were designed to confirm improvements to issues identified in the FY2023 results.

- Role, function and composition of the Board of Directors (6 questions)

- Operation of the Board of Directors (7 questions)

- Collaboration with auditing organizations and risk management (3 questions)

- Relationships with shareholders and investors (3 questions)

- Voluntary committees (2 questions)

- Issues for enhancing deliberation and sharing (1 question)

- Open-ended questions (4 questions)

Initiatives in FY2024

In FY2024, the following initiatives were conducted for issues identified in the effectiveness evaluation pertaining to FY2023.

Key issues |

Initiatives in detail |

|---|---|

|

|

Evaluation results in FY2024

As in FY2023, the Board effectiveness evaluation for FY2024 yielded generally positive results across all evaluation items, confirming that the Board is functioning not only effectively but also increasingly so. In particular, praise was given for the strong leadership demonstrated by management and the well-maintained composition and high-level of operation of the Board of Directors.

Although no urgent issues were identified in the interviews, there are some issues that should be addressed in order to further demonstrate the value of the Board of Directors. Accordingly, for FY2025 and beyond, the Board is pursuing initiatives focused on addressing the issues identified below, in order to continuously enhance the Board’s effectiveness.

Key issues |

Initiatives going forward |

|---|---|

|

|

We will continue to implement the necessary improvements, including the above-mentioned initiatives, with the aim of further improving effectiveness.

Succession Planning

We recognize that continuously producing next-generation management human resources to lead the future management of the Group, and expanding the candidate pool both qualitatively and quantitatively, is a particularly important challenge. In order to continuously produce leaders who possess the high-level skills and qualities necessary for global success, we select as future management candidates human resources at various organizational levels through open applications targeting employees of Group companies and recommendations from senior management, including Executive Officers, with the direct commitment and involvement of senior management, led by the CEO. For each candidate, at meetings aimed at supporting the growth of next-generation management human resources attended by the CEO, we carefully assess their qualifications as potential executives (including Executive Officers) capable of realizing the JT Group’s growth strategy, considering factors such as objective external evaluations and market competitiveness, along with integrity as a professional and extremely high levels of ownership combined with elevated and broad perspectives. We prioritize candidates for development, create development plans involving diverse and challenging work experiences, and regularly confirm their development status based on these plans, while also periodically discussing medium- to long-term growth issues and strategies related to development policies. In particular, for individuals recognized as potential candidates for positions such as Director and Audit & Supervisory Board Members, the Advisory Panel on Nomination and Compensation regularly verifies their development status while referencing insights from Independent Outside Directors who serve as committee members and external advisors, and it also discusses succession plans and planning processes with a view to enhancing both. One specific initiative is the JT-Next Leaders Program (NLP), which aims to continuously produce young top management to lead the JT Group’s domestic and international business operations. This program, launched in 2013, targets employees, from pre-employment candidates to employees up to the age of 40, who meet the application requirements; administers an objective selection process combining internal and external assessments such as human assessments, 360° surveys, and executive interviews; and provides priority growth support on a Group-wide scale for several years to qualified employees. Through such programs, we are continuing our efforts to enhance our pool of management human resources from a young age and to strengthen the competitiveness of our human resources.

Executive remuneration

Executive remuneration policy

The Board establishes policies on executive remuneration including the methodology used in determining each Director’s remuneration. These policies are determined after being deliberated and reported by the Advisory Panel on Nomination and Compensation, comprised entirely of Directors who do not serve as Executive Officers with more than half its members being Independent Outside Directors, in order to ensure independence and objectivity. Based on these policies, our basic concept for executive remuneration is as follows:

- Set remuneration at an adequate level to retain personnel with superior capabilities

- Link remuneration to the Company’s performance so as to motivate executives to achieve their performance targets

- Link remuneration to the Company’s value over the medium and long term

- Ensure transparency by implementing objective and quantitative frameworks

Process for setting executive remuneration

We benchmark the amount of remuneration for each Director based on a survey on remuneration for directors conducted by third parties, taking into account the remuneration levels at major Japanese manufacturers with similar sizes and profits (benchmark corporate group) that are operating overseas. Specifically, after benchmarking the level of base salaries for directors of peer companies and the percentage of variable remuneration including executive bonuses and medium- and long-term incentives, the amount of remuneration for each Director is determined using various calculation methods stipulated in internal regulations, based on deliberations by the Advisory Panel on Nomination and Compensation, within the maximum amount approved at the Ordinary General Meeting of Shareholders. Currently, the Board considers that the Representative Director, CEO is the most qualified to determine the amount of remuneration for each Director, having an overview of the Company’s management and performance as well as taking into account the evaluation of each Director’s execution of duties. Based on this concept, the Board delegates its determination to the Representative Director, CEO, who in turn determines the amount of remuneration for each Director including base salary, executive bonus, monetary compensation claims for the allotment of the restricted stock remuneration plan and the performance share unit plan, based on various calculation methods stipulated in internal regulations and in accordance with deliberation by the Advisory Panel on Nomination and Compensation. Thereafter, the Board concludes the Representative Director, CEO’s determination is aligned with the policies. In 2023, Masamichi Terabatake, the Representative Director, CEO, determined the amounts of remuneration.

Remuneration for Audit & Supervisory Board Members is also benchmarked in the same way, and is determined by deliberation among the Audit & Supervisory Board Members within the maximum amount approved at the Ordinary General Meeting of Shareholders.

Composition of executive remuneration

Executive remuneration is comprised of (1) a monthly “base salary” and (2) an “executive bonus” linked to the Company’s business performance in a fiscal year, as well as (3) a “restricted stock remuneration plan” and (4) a “performance share unit plan,” both of which are linked to corporate value over the medium and long term. The composition of executive remuneration is as follows.

Directors who also serve as Executive Officers

For the Directors who also serve as Executive Officers, remuneration consists of the base salary, executive bonus, restricted stock remuneration plan and performance share unit plan. The composition ratio of remuneration is as follows in cases where the executive bonus and the performance share unit plan are at the standard amount.

Composition |

Monetary |

Monetary remuneration (performance-linked) |

Stock |

Stock remuneration (performance-linked) |

|---|---|---|---|---|

|

Ratio*1 |

Base salary |

Executive bonus |

Restricted stock remuneration plan*2 |

Performance share |

|

38-43% |

||||

*1

The composition ratios vary depending on the duties of Members of the Board and the ranges are indicated in the table

*2

The ratio of restricted stock remuneration plan and performance share unit plan is about 3 to 1

*3

Under the performance share unit plan, 50% is paid as cash towards tax payment

*4

The above table shows the ratio of remuneration composition if the executive bonus and performance share unit plan are paid at the standard amount. The above ratios could fluctuate depending on the Company’s performance, share price, remuneration levels of benchmark companies, etc.

Internal Directors and non-executive officers

Internal Directors and non-executive officers receive remuneration that consists solely of a base salary and does not include performance-linked remuneration, as they are responsible for determining Group-wide management strategies to enhance corporate value and for fulfilling their supervisory functions, such as monitoring the execution of medium- and long-term growth strategies.

Outside Directors

Remuneration for Outside Directors is composed solely of a base salary and does not include performance-linked remuneration to ensure their independence. An Outside Director who serves as the Chairperson of the Advisory Panel on Nomination and Compensation receives remuneration at a level of the amount corresponding to the duty, in addition to the remuneration level of other Outside Directors.

Audit & Supervisory Board Members

Remuneration for Audit & Supervisory Board Members is composed solely of a base salary, in light of their key responsibility for conducting audits.

Components of executive remuneration

Base salary

Executives are remunerated with a monthly base salary commensurate with their responsibilities. They are individually evaluated on achievement of their performance targets, from the viewpoint of motivating them to achieve performance targets through execution of their duties and actions that will lead to the Company’s sustainable profit growth. Performance targets are set through interviews with the CEO at the beginning of the fiscal year and evaluated at the end of the fiscal year. The base salary for the following fiscal year will be set within a certain range reflecting the individual performance evaluations. However, an individual performance evaluation is not applicable to the CEO.

Executive bonus

The executive bonus for Directors who also serve as Executive Officers will be paid as monetary remuneration reflecting the Company’s performance for a fiscal year. Core revenue at constant currency, adjusted operating profit (AOP) at constant currency, adjusted operating profit on a reported basis, profit, and an RRP-related qualitative evaluation index*, which will be used to measure the performance of the business itself, act as KPIs in the calculation of executive bonuses, from the viewpoints of (1) providing shareholders with shared value related to the performance of the business itself, which is the foundation of sustainable profit growth, and the achievement rate of profit growth, and (2) setting indices conducive to sustainable profit growth over the medium and long term. In calculating the amounts of executive bonuses, 15% accounts for core revenue at constant currency, 35% for AOP at constant currency, 25% for adjusted operating profit on a reported basis and 25% for profit. The ratio that performance on a reported basis accounts for on the KPIs used to determine executive bonuses has been set to 50%. Performance-linked payout is based on KPI achievement in the range of 0% to 190% and either -10%, 0%, or +10% is added/deducted depending on evaluations of the RRP-related qualitative evaluation index. In the case that a Director who received an executive bonus engages in certain misconduct, the Director involved will be required to return part of the executive bonus already paid.

*

This is a qualitative evaluation metric related to the execution and achievement level of strategies for our focus area of Reduced-Risk Products (RRP).

Restricted stock remuneration plan

The restricted stock remuneration plan is designed to further enhance shared value over the medium and long term between the Directors who also serve as Executive Officers (hereinafter, eligible Directors) and the shareholders. Eligible Directors receive monetary compensation claims every fiscal year towards restricted shares and allocation of the Company’s common stock by paying all of the monetary compensation claims in kind in accordance with the resolution of the Board of Directors (the allotment being made from treasury shares). The Company enters into an agreement with the eligible Directors with regards to the allotment of the shares. Although the restriction period is thirty years, in cases where any eligible Director retires due to expiration of their term or resigns due to reasons deemed acceptable by the Board of Directors from a position as Director or any other position separately specified by the Board of Directors during the restriction period, the transfer restrictions are removed on all of the allotted shares that the eligible Director owns. Furthermore, upon the date of payment, in the case where any eligible Director, Audit & Supervisory Committee Member or Executive Officer loses their status due to expiration of their term or another reason deemed acceptable by the Board of Directors, the transfer restrictions are removed on all of the allotted shares that the eligible Director owns.

In the event that a Director who was allotted restricted shares has violated laws or regulations or any other cause as determined by the Board of Directors during the restriction period, all or part of the allotted shares will be acquired by the Company without compensation. Additionally, in cases where the Company is involved in mergers or other organizational realignments in which the Company is the absorbed entity during the restricted period, restrictions may be removed on the allotted shares prior to the effective date of the organizational realignment by resolution of the Company’s Board of Directors.

Performance share unit plan (PSU)

PSU is a performance-linked stock compensation system that aims to strengthen shared value with shareholders, to enhance the Company’s value over the medium and long term and to commit to achieving business results over the medium term. PSU offers monetary remuneration claims and cash to Directors who also serve as Executive Officers during the first year of the three-year performance evaluation period.*1 Compensation will be paid in the form of monetary claims and cash payments for issuance of the Company’s common stock based on the degree to which numerical targets, such as business performance, are reached during a given performance evaluation period. The attainment rates of numeric targets including earnings are determined following a review by the Advisory Panel on Nomination and Compensation. As a general rule, eligible Directors receive the cash and monetary claims after the end of each performance evaluation period. Eligible Directors receive allotments of the Company’s common stock through payment of all of the monetary remuneration claims in kind (the allotment is made from treasury shares).

We determine necessary indices to calculate the number of shares to be given to eligible Directors, including each numeric target used in this compensation system and performance-linked factors following a review by the Advisory Panel on Nomination and Compensation. In order to share value with shareholders, profit (attributable to the owners of the parent company) has been set as a PSU KPI for the evaluation period starting in 2021. For the evaluation period starting in 2022, we have decided to introduce an ESG-related index on top of profit, in order for the Company and shareholders to gain a mutual perspective of evaluating and being evaluated. The decision was made to enact this same change for the evaluation periods starting in 2023, 2024 and 2025. In 2022, 2023 and 2024, we included our progress on initiatives to realize Net-Zero as an ESG-related index, specifically the target attainment rates for reducing Greenhouse Gas (GHG) emissions. In addition to indices related to efforts to achieve Net-Zero, the ESG-related index for 2025 will include those efforts to promote DE&I, which are part of the JT Group Sustainability Targets. In particular, the JT Group will use the achievement of a target ratio of females in management positions to evaluate this. Furthermore, for the evaluation period starting in 2025, we have decided to introduce an RRP-related quantitative evaluation index*2 in addition to profit and an ESG-related index. The aim is to further promote shared value with shareholders by achieving medium-term performance targets and contributing to improved corporate value.

Performance-linked payout is set to be in the range of 0% to 200% based on KPI (i.e., profit) achievement for the evaluation period starting in 2021. In evaluation periods starting in 2022, 2023 and 2024, performance-linked payout is set to be in the range of 0% to 190% based on KPI achievement and either -10%, 0%, or +10% is added/deducted depending on evaluations of the ESG-related index. In the evaluation period starting in 2025, performance-linked payout will fluctuate between 0% and 180% depending on KPI achievement, and either -5%, 0%, or +5% will be added/deducted depending on the achievement level of the GHG emission reduction target on the ESG-related index. Depending on the achievement level of the JT Group’s target ratio of females in management positions, either -5%, 0%, or +5% will be added/deducted, and depending on the level of achievement of the RRP-related quantitative evaluation index, either -10%, 0%, or +10% will be added/deducted.

In the case we acknowledge certain wrongful behavior as determined by the Board of Directors or any other illegal acts have been committed by a Director during the performance evaluation period, the Director will be disqualified from receiving all or part of the cash and monetary claims planned to be paid.

*1

The performance evaluation period for 2021 is the three-year period from FY2021 to the end of FY2023, 2022 is the three-year period from FY2022 to the end of FY2024, 2023 is the three-year period from FY2023 to the end of FY2025, and 2024 is the three-year period from FY2024 to the end of FY2026. From 2025 onwards, we plan to offer performance-linked PSU’s to Directors who also serve as Executive Officers during the first fiscal year of each three-year performance evaluation period. The maximum amount is approved at the Ordinary General Meeting of Shareholders.

*2

This is a quantitative evaluation index related to the degree to which the sales volume of heated tobacco sticks (HTS) is achieved in RRP, one of our focus areas.

KPIs for executive remuneration

We have introduced financial and non-financial indicators as KPIs to design a more multifaceted system for assessing our performance. This will allow us to evaluate our initiatives aimed at medium- and long-term growth and further strengthen shared value with shareholders.

Executive bonus

KPI |

Purpose/Details |

Ratio |

|---|---|---|

|

Core revenue at constant currency |

Assess top-line growth rate. Introduced given the significance of assessing top-line growth to realize medium- and long-term sustainable profit growth |

15% |

|

Adjusted operating profit at constant currency |

Assess performance of business itself, which is the foundation of sustainable profit growth |

35% |

|

Adjusted operating profit on a reported basis |

Assess business performance including FX impact. Introduced to assess current performance from a multifaceted perspective considering the balance between the constant FX basis and reported basis |

25% |

|

Profit |

Introduced to share attainment rate of profit growth with shareholders |

25% |

|

RRP-related qualitative evaluation index |

Assess qualitatively the implementation of strategies and attainment rate regarding RRP, our focus area |

±10% |

Performance share unit plan (PSU)

KPI |

Purpose/Details |

Ratio |

|---|---|---|

|

Profit |

Introduced to share attainment rate of profit growth with shareholders |

100% |

|

ESG-related index |

Introduced in order for us (evaluatee) and shareholders (evaluator) to gain a mutual perspective on what is conducive to corporate value. |

(1)±5% |

|

RRP-related quantitative evaluation index* |

Introduced to further promote shared value with shareholders by achieving medium-term performance targets and contributing to improved corporate value |

±10% |

*

This is a quantitative evaluation index related to the degree to which the sales volume of HTS is achieved in RRP, one of our focus areas.

Total amount of remuneration in 2024

Category |

Total amount (JPY MM) |

Total amount by component (JPY MM) |

Number of eligible persons |

|||

|---|---|---|---|---|---|---|

Base salary |

Executive bonus |

Restricted stock remuneration plan |

PSU |

|||

Directors (excluding Outside Directors) |

1,252 |

473 |

395 |

278 |

107 |

6 |

Audit & Supervisory Board Members (excluding Outside Members) |

88 |

88 |

― |

― |

― |

2 |

Outside Directors |

195 |

195 |

― |

― |

― |

9 |

Total |

1,535 |

756 |

395 |

278 |

107 |

17 |

Notes: 1.

Figures for PSU in the table represent those booked as expenses for 2024

2.

Executive bonus and PSU are categorized as performance-linked remuneration

3.

The restricted stock remuneration plan and PSU are categorized as non-monetary compensation

4.

The table above includes a Director and an Outside Director who retired on March 22, 2023

Maximum amount of executive remuneration

The maximum total amount of executive remuneration for all Directors is as follows. The Company’s Audit & Supervisory Board Members are eligible only for base salary and the maximum total amount of remuneration is set at 240 million yen per annum.

Amount of executive |

Internal Directors |

Outside |

|||

|---|---|---|---|---|---|

Executive |

Non-executive |

||||

Base salary |

Up to 800 million yen |

○ |

○ |

○ |

|

Executive bonus |

Up to 0.3% of profit |

○ |

— |

— |

|

Restricted stock remuneration plan |

Total amount of monetary remuneration |

Up to 600 million yen |

○ |

— |

— |

Number of shares to be issued |

Up to 300,000 shares |

||||

PSU |

Total amount of monetary remuneration and cash for tax payments |

Up to the amount obtained by multiplying fixed number of base share units*1 (up to 200,000 shares) with the share price at offering*2 |

○ |

— |

— |

Number of shares to be issued |

Up to 100,000 shares |

||||

*1

Number of base share units (determined by the Board of Directors based on the duties, etc. of respective eligible Directors) x Offering ratio (within a range of 0-200% based on the degree of achievement of targets)

*2

After the performance evaluation period ends, based on the closing price of the ordinary shares of the Company on the TSE on the preceding business day of the date of the resolution by the Board of Directors concerning the allotment of the ordinary shares of the Company under the plan (or the closing price on the immediately preceding business day, if transactions are not executed on that day), the amount shall be determined by the Board of Directors within the range not particularly favorable to eligible Directors