The JT Group is committed to being a responsible corporate citizen across all areas of our operations, and in all countries in which we source, manufacture, or sell our products. This is an essential component of how we work as a business and who we are as a company.

This global commitment is driven by a management philosophy that puts key stakeholder groups at the heart of our everyday decisions and actions. Our 4S model ensures that we strive to fulfill our responsibilities to our valued consumers, shareholders, employees and the wider society, carefully considering the respective interests of these four key stakeholder groups, and exceeding their expectations wherever we can. Effective compliance, audit and risk management play important roles in how we conduct ourselves, everywhere.

Tax practices

This is particularly true in the increasingly complex area of taxation. Our tax commitment is unequivocal: “We are fully committed to paying our fair share of taxes within both the letter and the spirit of the law.” In doing so, we aim for our tax affairs to be transparent and sustainable in the long term, and we do not engage in aggressive tax planning, or tax avoidance schemes. We neither use legal entities, secrecy jurisdictions, or tax havens, purely for tax purposes, nor will we undertake tax planning for tax avoidance reasons or without commercial justification. We undertake to meet all legal requirements and make all appropriate returns and payments on time. We communicate closely and transparently with tax authorities to enhance their understanding of our business.

In areas of uncertainty, we seek to discuss our interpretation of tax rules with tax authorities and, where appropriate, obtain tax rulings. Where disputes arise with tax authorities with regard to the interpretation and application of legislation, we are committed to addressing the issues promptly and resolving them in an open and constructive manner.

Our Group Tax Policy

The JT Group Tax Policy (hereinafter, the “Policy”) outlines the framework for ensuring appropriate conduct of tax affairs to enhance the corporate value through our “4S” model. This policy provides general guidance in respect of tax compliance, tax management and the use and engagement of external tax advisors, and relationships with tax authorities and business partners within the JT Group. This policy is approved by the JT Group CEO.

Basic Policy

A)Tax Compliance

JT Group will:

- Comply within both the letter and spirit of local laws and regulations in every country and region in which JT Group conducts business

- Use the arm's length principle for all transfer pricing

- Submit tax returns accurately and in time

- Make tax payment when due

- Retain adequate documentation supporting its tax filings and payments

- Comply with IFRS and / or local GAAP accounting as appropriate to their business, in respect of Taxes

- Comply with Operating Guidelines related to the Policy

- Report to JT management on regular basis in order to confirm compliance

B)Tax Risk Management

JT Group will:

- Seek a consistent and balanced approach regarding Tax Risk Management

- Demonstrate the highest level of integrity and abide by the highest standards and comply with laws, regulations and other rules

JT Group will not:

- Use an entity only for tax purposes

- Use secrecy jurisdictions or tax havens only for tax purpose

- Undertake tax planning for tax avoidance reasons or without commercial justification.

C)Utilization of External Tax Advisers

JT Group establishes and maintains relationships with External Tax Advisers for the followings:

- Achieve the highest quality of Tax Compliance and Tax Risk Management

- Ensure efficient and effective utilization of External Tax Advisers

- Ensure the highest standards of service at the lowest cost level

- Reduce the reliance on External Tax Advisers in order to develop the internal capabilities within the JT Group

- Where necessary for attorney/ client legal privilege, ensure consideration is given to use of a legal firm as External Tax Advisers

D)Relationship with tax authority

JT Group will:

- Maintain the appropriate level of relationship with tax authorities to ensure a high standard of corporate reputation

- Maintain a proactive, open and transparent communication with tax authorities in order to enhance their understanding of the JT Group business and resolve matters in a constructive manner where disputes arise with regard to the interpretation and application of tax legislation

Our tax control framework

Our objective is to manage tax risk and pay what is rightly due.

The main areas of tax risks we identified relate to tax law changes, compliance and reporting:

- Tax law changes: exposure driven by tax law changes enacted unexpectedly, retroactive legislation, changes in interpretation or application of tax laws by authorities.

- Compliance: non-compliance with global or local tax laws and regulations, including wrong application of tax regulations, errors / delays in tax filings, documentation and reporting, incorrect interpretation of transfer pricing guidelines and/or taxation laws by JTI employees, advisers or regulatory bodies.

- Reporting: inability to estimate existing or future tax obligations and record appropriate provisions.

All risk areas are monitored and managed closely via our tax control framework:

Tax affairs within the JT Group are managed by our experienced in-house tax team, who are actively involved in all major commercial and operational transactions. To control the tax risks JT Group’s tax team uses external consultants; conducts tax health checks; keeps up to date via tax literature, newsletters, external training, and membership of tax professional organizations; and mandatorily and regularly applies web-based tools to capture changes in existing and new tax positions and compliance status.

Significant tax positions, and the risks arising from these - together with potential mitigating actions - are considered by the relevant level of management when strategic decisions impacting each company are taken. We also seek advice from external professional advisers or look for pre-alignment with tax authorities for material transactions where appropriate, to minimize potential risk.

The allocation of responsibility is clearly set out in the JT Group Operating Guidelines and the JT Group Tax Policy. Material transactions and issues are considered by relevant boards. There is a regular review of material transactions and tax positions by senior management. Adherence to our operating guidelines in respect of authorization and approval levels for all transactions and compliance tax matters is mandatory.

The JT Group Tax Policy is reviewed and approved by the JT Group CEO. The tax strategy of each entity is reviewed regularly. The responsibility for this - as well as management of tax risks, rests with the Chief Financial Officer of each entity, together with the Global Tax Vice President.

Our effective tax rate

The effective statutory tax rate in Japan is 30.43% (FY22). However, as we, as a Japanese multinational, also have operations outside Japan, the profits we generate cannot be taxed in Japan only. In order to come to a logical effective tax rate, we use a blended rate representing a blend of the local statutory rates applicable for each market, of which most have a lower tax rate than the effective statutory tax rate in Japan. As mentioned in our Group Tax Policy, we use international transfer pricing standards to safeguards that all markets have the opportunity to levy tax upon the profits allocable to their markets and get their fair share of taxes.

The amount of corporate income taxes, including deferred income taxes, amounted to 149,277 million yen, which represents the effective tax rate of 25.15% in 2022. Adjustments will be seen as the reported profits will not fully align with the taxable profits in the markets due to the applicability of local tax laws. The reconciliations between the effective statutory tax rate in Japan and the calculated effective tax rate (ETR) for JT can be specified as follows:

| (%) | |

|---|---|

| Effective statutory tax rate in Japan | 30.43 |

| Different tax rates applied to foreign subsidiaries | (11.37) |

| Non-deductible expenses | 2.72 |

| Non-taxable incomes | (1.12) |

| Valuation allowance | 1.47 |

| Tax credits | (1.44) |

| Retained earnings | 1.35 |

| Withholding tax in foreign countries | 1.16 |

| Other | 1.95 |

| ETR in 2022 | 25.15 |

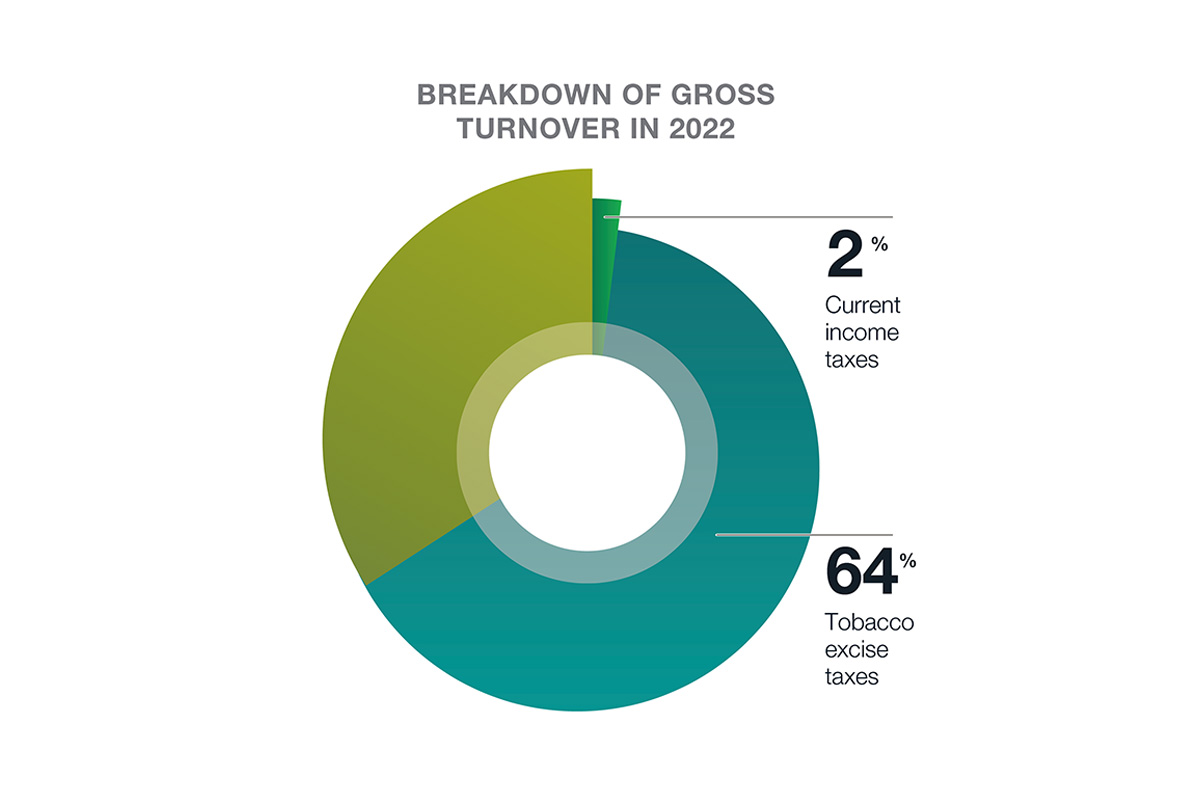

Our tax contribution

As one of the world’s largest tobacco companies, we make significant contributions to government revenues through taxation. In 2022, approximately 66% of 9,229,388 million yen gross revenue flowed back into global society through tobacco excise and corporate taxes. We accrued 5,930,211 million yen in tobacco excise taxes, amounting to 64% of global revenues; and 176,545 million yen in current income taxes (corporate tax), accounting for a further 2% of revenue. Besides this, we are responsible for the collection and payment of other taxes including employment taxes and other indirect taxes. Collectively, we believe these taxes paid contribute to funding many essential services on which current and future generations may depend.

Tax has also been recognized as an important sustainability subject by the JT Group’s senior leadership. This is reflected in the JT Group sustainability strategy.

To help the Group to grow, and to build a sustainable future as a member of the society in which we operate, we have identified high-priority material issues. Tax practice is one of these topics. It is also a focus area of “Good governance and business standards”, one of our group’s sustainability initiatives. Read more on “Materiality”.

The above tax statement is also published for and on behalf of all U.K. sub-groups and qualifying U.K. entities in our Group, in accordance with the requirement to publish a tax strategy for each financial year under section 161 and paragraph 19 of Schedule 19 to the Finance Act 2016 in relation to the year ended 31 December 2021. The above references to tax authorities include the U.K.’s HMRC. A link to the above information, which applies to all UK entities, is included in the JTI UK website.